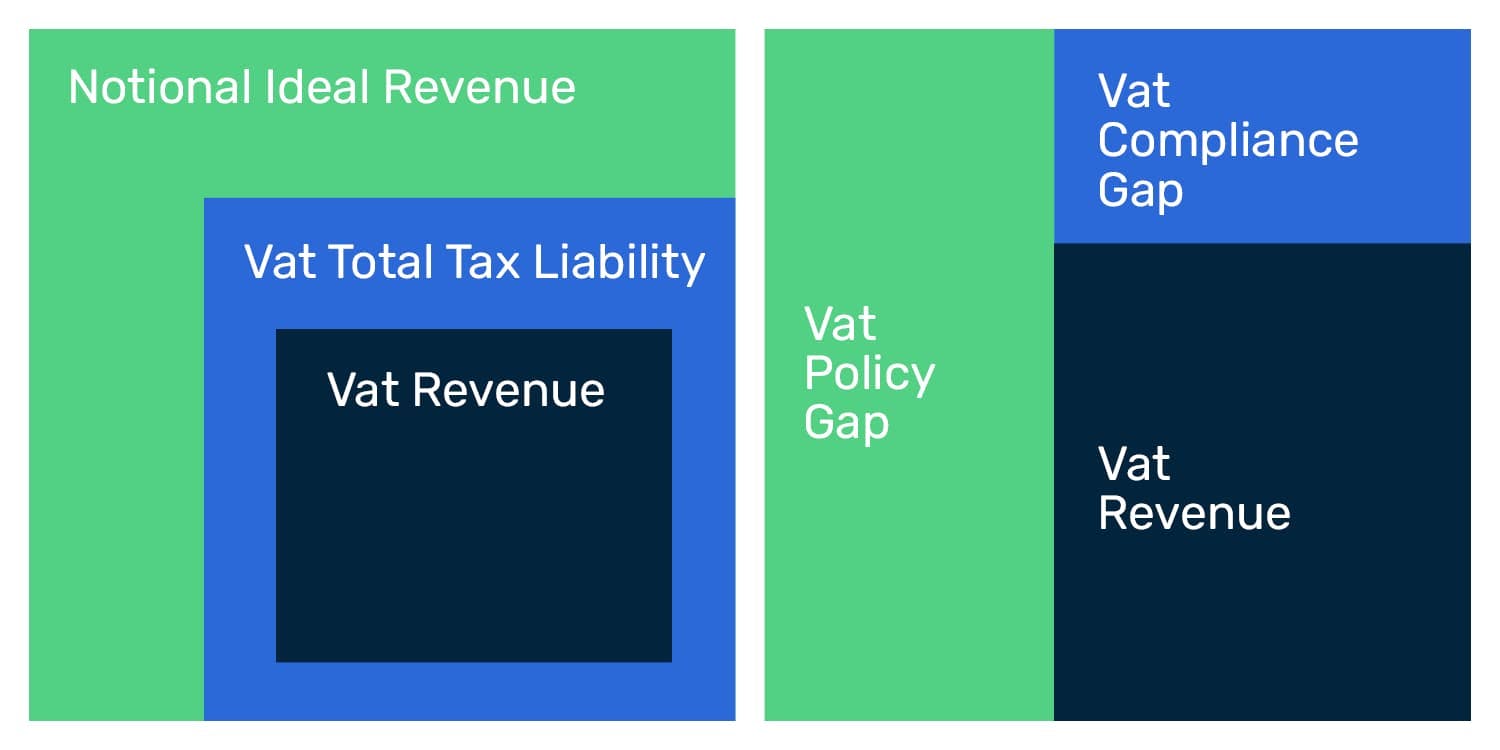

The Revenue Administration—Gap Analysis Program: Model and Methodology for Value-Added Tax Gap Estimation

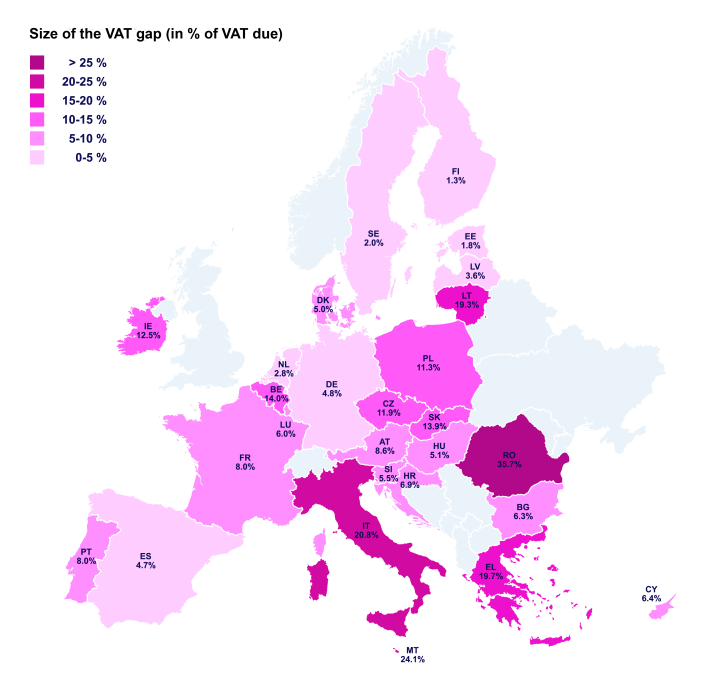

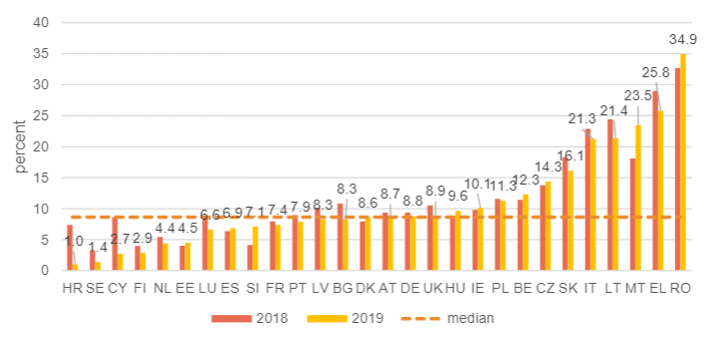

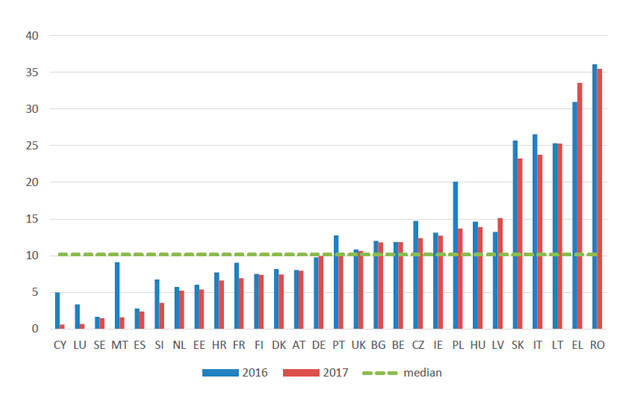

CASE Report No. 503: Study and Reports on the VAT Gap in the EU-28 Member States: 2020 Final Report - CASE - Center for Social and Economic Research

Study and Reports on the VAT Gap in the EU-28 Member States - CASE - Center for Social and Economic Research

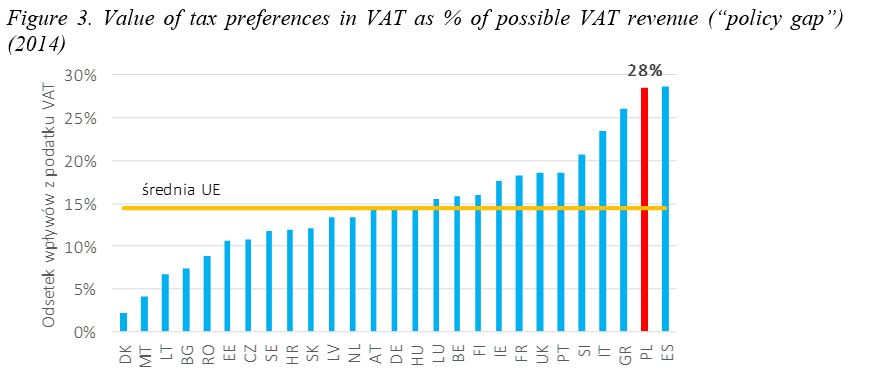

Sustainability | Free Full-Text | VAT Efficiency—A Discussion on the VAT System in the European Union