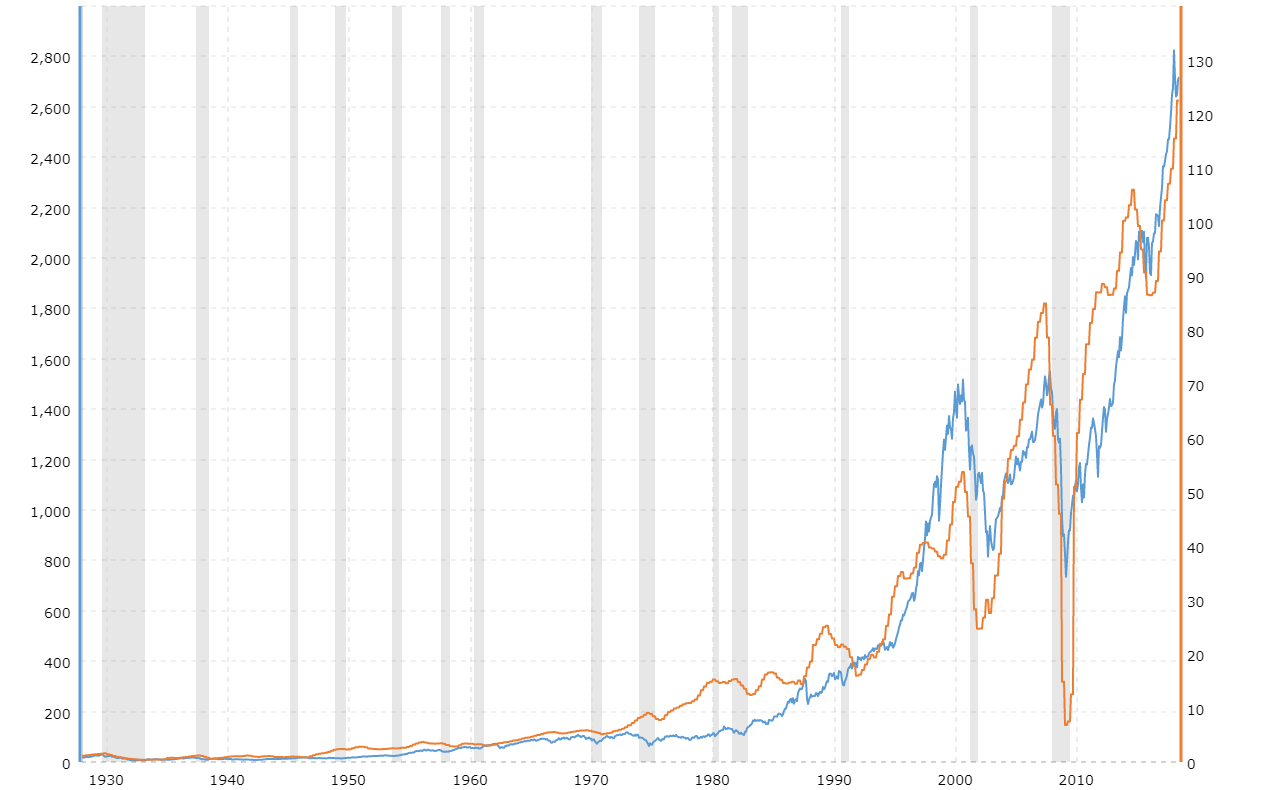

Highly valued S&P 500 index is 'near the top of its 85-year trend channel,' says Deutsche Bank - MarketWatch

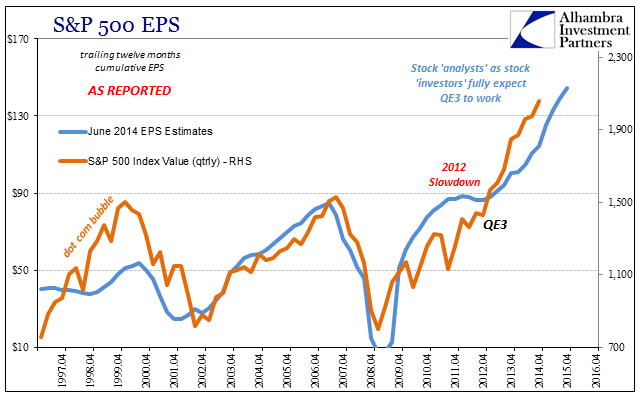

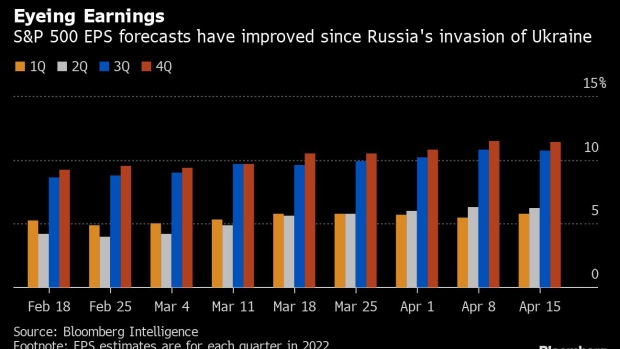

Holger Zschaepitz on Twitter: "Goldman cut S&P 500 end-2022 target from 4700 to 4300 on rate risk & growth fears despite fact that earnings 2022 EPS growth forecast boosted to +8% from +

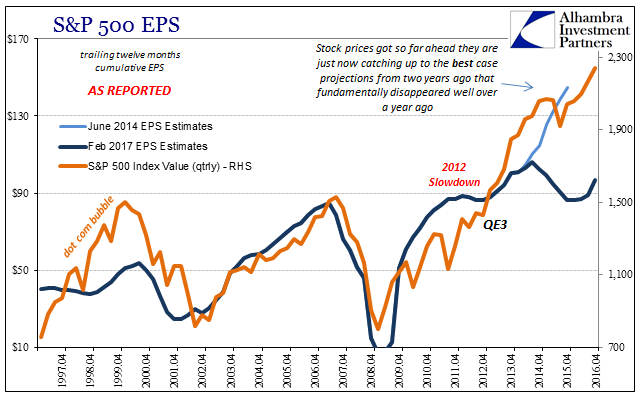

ISABELNET on Twitter: "🇺🇸 EPS Currently, the S&P 500 Index prices in a 15% decline in EPS. A decline of 33% from 2019 seems more appropriate, according to Goldman Sachs 👉 https://t.co/3SVJ18RESn

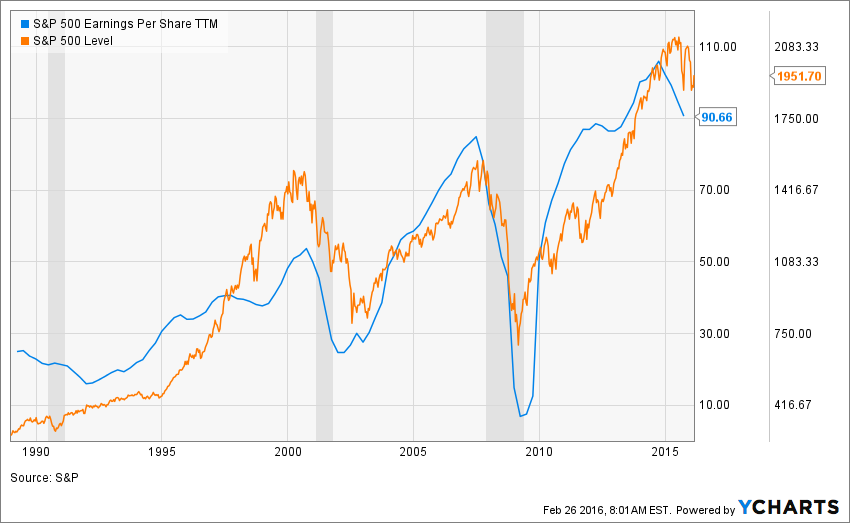

The S&P 500 has dipped into bear market territory, plunging as much as 25% from its January's peak. Where could the index be headed next and what can we watch in July?

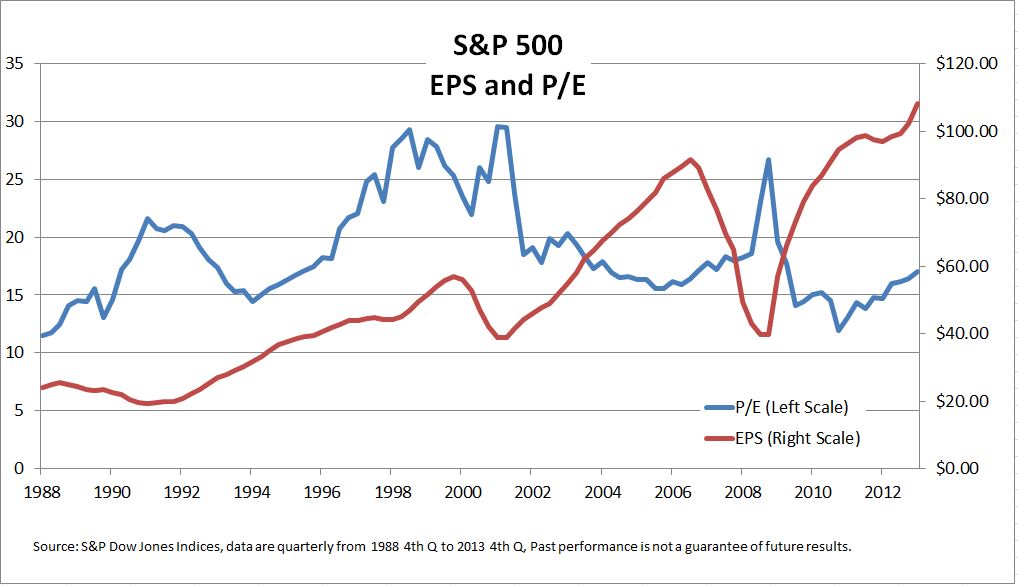

Insight/2020/05.2020/05.11.2020_TOW/S%26P%20500%20Forward%2012-Month%20PE%20Ratio%2020%20Years.png)

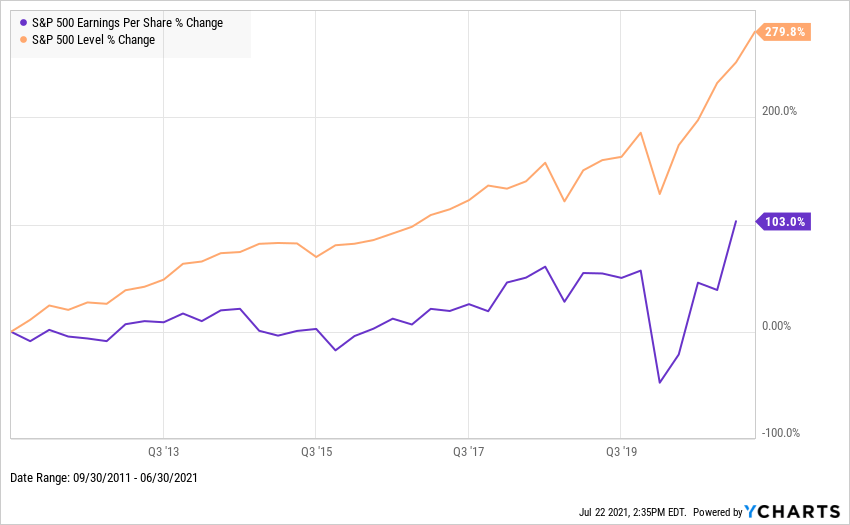

Insight/2020/05.2020/05.11.2020_TOW/S%26P%20500%20Change%20in%20Forward%2012M%20EPS%20vs%20Price%2020%20Years.png)