Effective marginal tax rates on corporate income. OECD. 2012 Source:... | Download Scientific Diagram

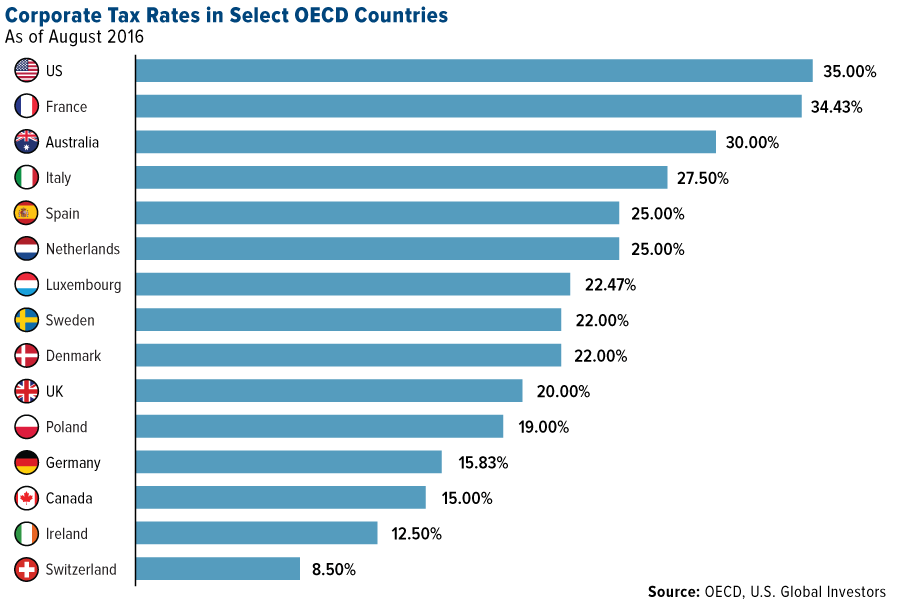

The Cato Institute - The United States has the third highest marginal effective corporate tax rate among 34 OECD countries. The U.S. rate in 2017 is 34.8%, which compares to the OECD