The Anti-Poverty, Targeting, and Labor Supply Effects of the Proposed Child Tax Credit Expansion | BFI

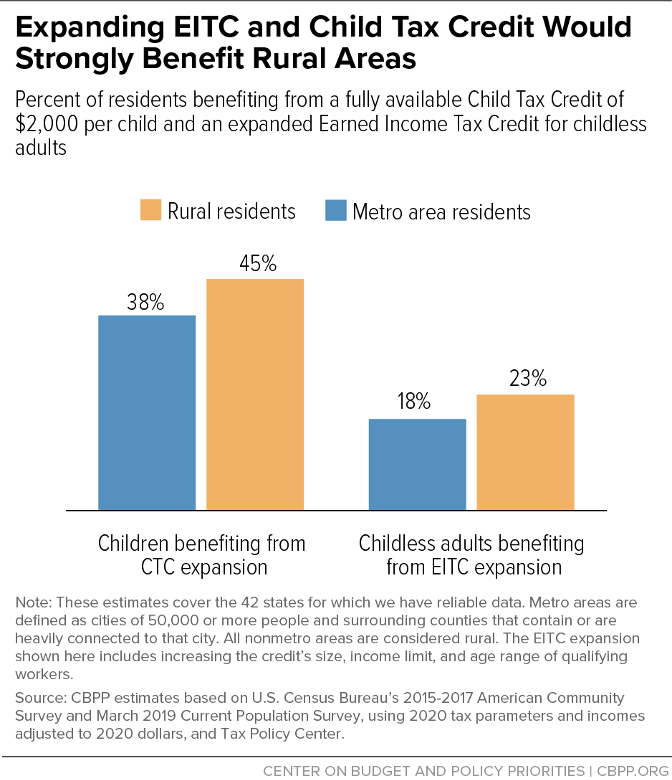

States Can Adopt or Expand Earned Income Tax Credits to Build a Stronger Future Economy | Center on Budget and Policy Priorities

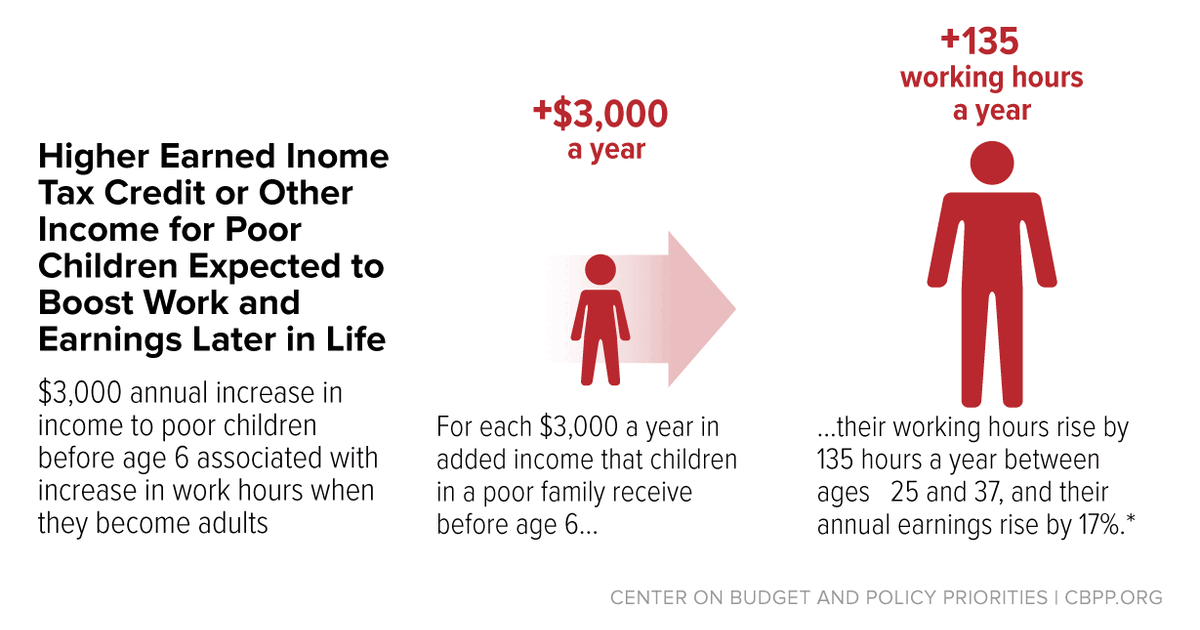

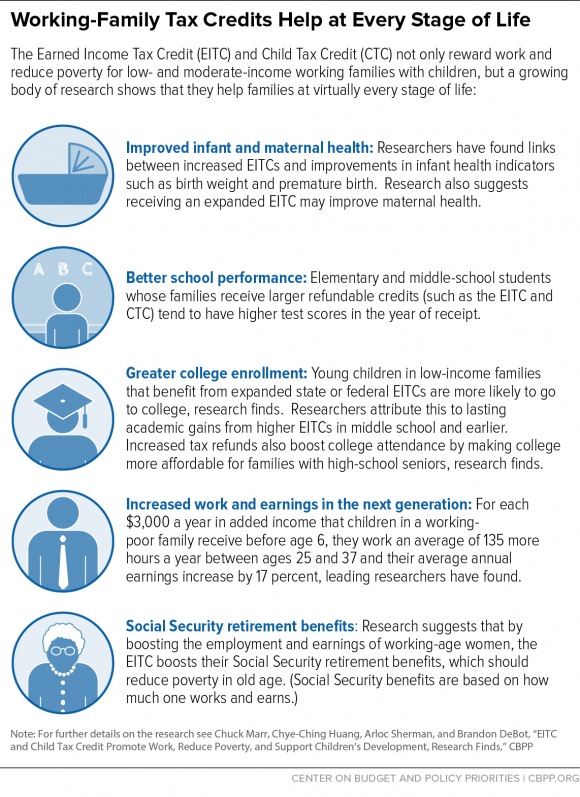

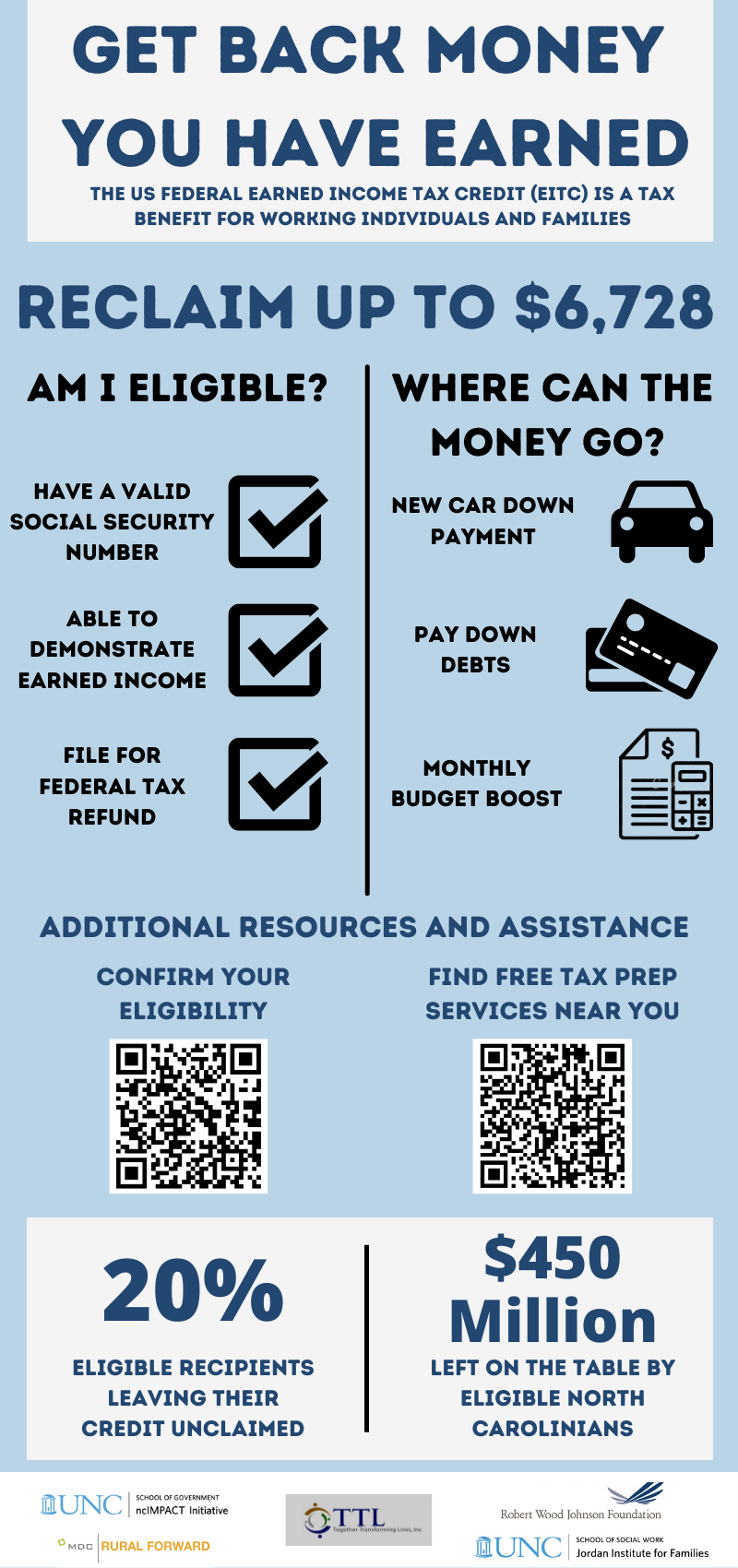

EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children's Development, Research Finds | Center on Budget and Policy Priorities

Chart Book: The Earned Income Tax Credit and Child Tax Credit | Center on Budget and Policy Priorities

Working Individuals, Families Urged to Meet with Volunteer Tax Preparers to Check Earned Income Tax Credit Eligibility - State of Delaware News

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)